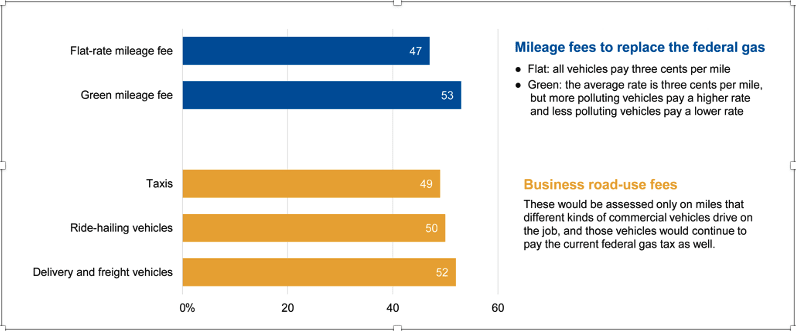

The Mineta Transportation Institute (MTI) released the topline results from its 12th annual survey exploring public support for federal transportation taxes and fees, which found that 53% of Americans supported the concept of a “green” mileage fee. The fee described would charge drivers an average rate of three cents per mile driven, with lower rates for less polluting vehicles and higher rates for more polluting vehicles.

The survey findings offer a snapshot of current public opinion about mileage fees at a time when both Democratic and Republican officials are openly discussing them as a possible replacement for the gas tax. Mileage fees are expected to be part of the conversation when Transportation Secretary Pete Buttigieg speaks about President Biden’s infrastructure priorities to the House Committee on Transportation and Infrastructure. Both ranking members of that committee — Rep. Pete DeFazio (D-OR) and Rep. Sam Graves (R-MO) — have already expressed support for investigating mileage fees.

The MTI survey series has documented steadily increasing growth in mileage fees. In 2010, the first year of the survey series, support for the green mileage fee was only 33%. This year’s 53% support is 20 percentage points higher.

This year’s survey also found that Americans would like to see any new mileage fee consider equity and ability to pay. Close to two-thirds (62%) thought that if Congress adopts a mileage fee, low-income drivers should pay a reduced rate.

Other key 2021 survey findings about mileage fees include:

Just over half of respondents (52%) thought mileage fee rates should be lower for electric vehicles than for gas and diesel vehicles.

If Congress were to adopt a federal mileage fee to replace the gas tax, three quarters of people (76%) would prefer to pay monthly or at the time they buy fuel or charge a vehicle. By comparison, only 24% who would prefer to pay an annual bill.

Approximately half of respondents also supported the idea of a “business road-use fee” that would be assessed on the miles that commercial vehicles drive on the job: 52% of people supported such a fee on delivery and freight trucks, 50% supported such a fee on ridehailing vehicles, and 49% supported such a fee on taxis.

The survey data for this study was collected from a nationally representative sample of 2,516 adults living in the U.S. Respondents completed the online survey between February 5 and February 23, 2021.

In June, the Mineta Transportation Institute will release a detailed report on the survey findings. This report will present findings related to both the federal gas tax and mileage fees, compare the opinions of different population subgroups (e.g., people who drive vs. those who do not), and discuss how public opinion on federal transportation taxes has evolved since 2010.