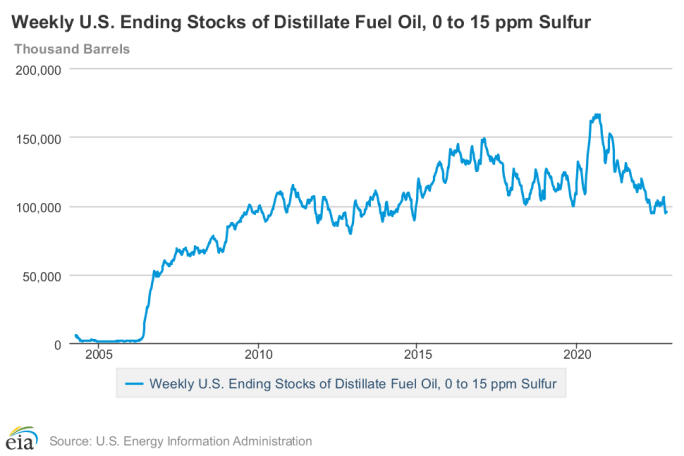

While stockpiles of distillate fuels (diesel fuel and heating oil) are low, the country is not going to suddenly run out of diesel fuel by Thanksgiving, despite reports of a “diesel fuel shortage” driven by widespread misunderstanding of a government statistic.

However, what those low stocks do mean is higher diesel fuel prices, especially in the Northeast where stocks are the lowest and diesel faces competition from fuel oil for home heating in the winter. On a normal day, the East Coast markets have 50 million barrels in storage, but right now, there are less than 25 million barrels available.

U.S. Energy Information Administration (EIA) data for the week ending Oct. 21 showed the U.S. has 25.9 days’ worth of supply of diesel fuel. But that would only happen if U.S. refineries stopped producing distillates completely and we stopped all imports from other countries. It’s calculated by taking U.S. inventory and dividing it by daily demand. However, some in the media and on social media have misinterpreted that to literally mean the country will run out of diesel fuel by Thanksgiving, and that's just not true.

Patrick De Haan, @GasBuddyGuy, explains that this number is a measurement of supply and demand, and that it’s “a sign that refiners are having a hard time keeping up as that number is usually ~33 days, and has dropped to numbers historically low. If refiners can outpace demand, the number will only slowly rise... but again, this number DOES NOT MEAN outages are imminent.”

It is more of a sign that refiners are having a hard time keeping up as that number is usually ~33 days, and has dropped to numbers historically low. If refiners can outpace demand, the number will only slowly rise... but again, this number DOES NOT MEAN outages are imminent.

— Patrick De Haan ⛽️📊 (@GasBuddyGuy) October 31, 2022

Looking specifically at the ultra-low-sulfur diesel used in on-highway trucks and buses, stocks have been around 95 million gallons for the weeks ending Oct. 14 and Oct. 21, according to the Energy Information Administration, down from 106.6 million in mid-September. The last time it was in this territory was late April/early May of this year — but before 2022, we have to go back to November 2014 to see ULSD stocks dip below 100,000.

Shrinking Stockpiles Don't Mean a Diesel Fuel Shortage

There are several factors at play in the low distillate stocks:

Fall is a time when refineries typically do maintenance. Tom Kloza with the Oil Price Information Service told CNBC, “October had the most refinery maintenance in the United States probably in a number of years.”

U.S. refinery capacity has fallen in the past few years as some unprofitable refineries were closed.

The cutoff of Russian oil imports. According to Forbes, before Russia’s invasion of Ukraine, the U.S. was importing nearly 700,000 barrels per day of petroleum and petroleum products. “Most of those imports were finished products and refinery inputs that boosted distillate supplies in the U.S.”

“Refineries do have a small amount of flexibility in shifting gasoline production to diesel production,” wrote Forbes' Robert Rapier. “But it’s a relatively small amount.”

Some ocean tankers carrying diesel to Europe have been re-routed to the U.S., reported Reuters.

Stocks of ultra-low-sulfur diesel.

Source: U.S. Energy Information Administration

Higher Distillate Demand

At the same time, there’s increased demand for diesel fuel, as a Mississippi River drought is forcing barge freight onto trucks and a possible rail strike looms.

And in the Northeast, as we head into winter, the demand for heating oil is a factor.

In its Oct. 12 Short-Term Energy Outlook, the EIA forecast that average household expenditures for home heating fuels will increase this winter because of both higher expected fuel costs and higher energy consumption due to colder temperatures. Compared with last winter, it predicts heating oil prices will rise by 27% from October–March.

Tom Kloza of the Oil Price Information Service told CNBC, “I think the fact that we’ve got this warning signal at the end of October and beginning of November helps. There’s tremendous profit motive out there to get refineries back up and running.”

With that motive, Kloza said the situation could improve in November.

“Once you get to December and January, there’s really no difference between the molecules in heating oil and diesel and then you might be sending a bunch of diesel to be burned up in the chimneys of homeowners in New England.”

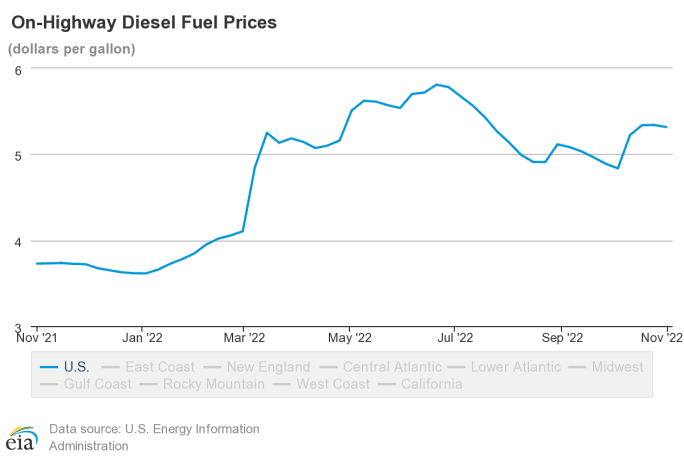

Low distillate stockpiles and higher demand mean higher diesel prices.

Source: U.S. Energy Information Administration

Higher Diesel Fuel Prices

All this means that, while we don't have a diesel fuel shortage, the high diesel prices we’re seeing aren’t likely to go away anytime soon. Diesel prices are averaging more than $1.50 higher than gasoline at the pump and many expect the price of diesel to go higher.

As of the EIA’s Oct. 31 report, gasoline prices averaged $3.742 per gallon nationally, 35 cents higher than a year ago. But the national average for a gallon of diesel was $5.317, $1.59 higher than a year ago.

Both dropped a few cents from the previous week.

It is possible that some short-term regional shortages of fuel could occur. Mansfield Energy's Alan Apthorp wrote on Oct. 31, "Some cities might run dry on diesel for a few days, at least at the terminal level. But the fuel supply chain is dynamic, and suppliers will rally to fill in any gaps in supply.... those shortages will drive up prices, which will make it economical to long-haul product from surrounding markets which do have supply. The fuel will be delivered but at higher costs."

In addition, governments can act to help expedite the transport of fuel. For instance, the governor of South Dakota issued an emergency waiver of hours-of-service rules for truckers transporting fuel. As of Nov. 8, the governors of Iowa and Nebraska had issued similar waivers.

Updated 11/3 to add information about possible regional effects.

Updated 11/8 to add additional states issuing emergency waivers for transporting fuel.

More insight from Mike Antich with sister fleet brand Automotive Fleet: